Gross Margin vs Contribution Margin: What’s the Difference?

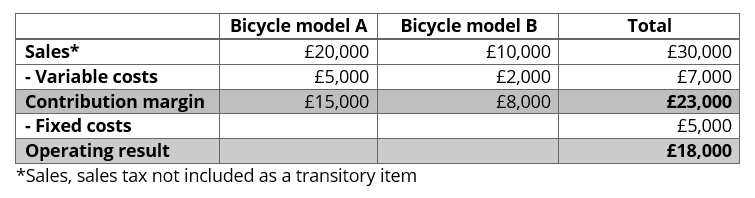

For the month of April, sales from the Blue Jay Model contributed \(\$36,000\) toward fixed costs. Looking at contribution margin in total allows managers to evaluate whether a particular product is profitable and how the sales revenue from that product contributes to the overall profitability of the company. In fact, we can create a specialized income statement called a contribution margin income statement to determine how changes in sales volume impact the bottom line. If total fixed cost is $466,000, the selling price per unit is $8.00, and the variable cost per unit is $4.95, then the contribution margin per unit is $3.05.

Contents

Along with the company management, vigilant investors may keep a close eye on the contribution margin of a high-performing product relative to other products in order to assess the company’s dependence on its star performer. Another common example of a fixed cost is the rent paid for a business space. A store owner will pay a fixed monthly cost for the store space regardless of how many goods are sold. However, it may be best to avoid using a contribution margin by itself, particularly if you want to evaluate the financial health of your entire operation. Instead, consider using contribution margin as an element in a comprehensive financial analysis.

Contribution Margin: Definition, Overview, and How To Calculate

The fixed costs for a contribution margin equation become a smaller percentage of each unit’s cost as you make or sell more of those units. Regardless of how contribution margin is expressed, it provides critical information for managers. Understanding how each product, good, or service contributes to the organization’s profitability allows managers to make decisions such as which product lines they should expand or which might be discontinued.

Unit Contribution Margin vs. Total Contribution Margin

However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin. It appears that Beta would do well by emphasizing Line C in its product mix. Moreover, the statement indicates that perhaps prices for line A and line B products are too low. This is information that can’t be gleaned from the regular income statements that an accountant routinely draws up each period. The contribution margin is computed as the selling price per unit, minus the variable cost per unit.

- For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s.

- Variable expenses directly depend upon the quantity of products produced by your company.

- The Contribution Margin is the incremental profit earned on each unit of product sold, calculated by subtracting direct variable costs from revenue.

- Calculations with given assumptions follow in the Examples of Contribution Margin section.

And as we mentioned earlier, a negative margin indicates the cost of producing the product exceeds its revenue. As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making. In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit.

All of our content is based on objective analysis, and the opinions are our own. There is no definitive answer to this question, as it will vary depending on the specific business and its operating costs. However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low. If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred. The following examples show how to calculate contribution margin in different ways. This is one reason economies of scale are so popular and effective; at a certain point, even expensive products can become profitable if you make and sell enough.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. As of Year 0, the first year of our projections, our hypothetical company has the following financials. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

The higher the number, the better a company is at covering its overhead costs with money on hand. Very low or negative contribution margin values indicate economically nonviable products whose manufacturing and sales eat up a large portion of the revenues. Investors examine contribution margins to determine if a company is using its revenue effectively.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Using the provided data above, we can calculate the price per unit by dividing the total product revenue by the number of products sold. However, the contribution margin facilitates product-level margin analysis on a per-unit basis, contrary to analyzing profitability on a consolidated basis in which all products are grouped together.

The gross margin shows how well a company generates revenue from direct costs such as direct labor and direct materials costs. Gross margin is calculated by deducting COGS from revenue, dividing the result by revenue, and multiplying by 100 to find a percentage. On the key small business lessons and trends from xerocon south 2016 other hand, variable costs are costs that depend on the amount of goods and services a business produces. The more it produces in a given month, the more raw materials it requires. Likewise, a cafe owner needs things like coffee and pastries to sell to visitors.

As a percentage, the company’s gross profit margin is 25%, or ($2 million – $1.5 million) / $2 million. In effect, the process can be more difficult in comparison to a quick calculation of gross profit and the gross margin using the income statement, yet is worthwhile in terms of deriving product-level insights. For this section of the exercise, the key takeaway is that the CM requires matching the revenue from the sale of a specific product line, along with coinciding variable costs for that particular product. On the other hand, the gross margin metric is a profitability measure that is inclusive of all products and services offered by the company. In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential.

Leave a Reply