Debt-to-Equity D E Ratio Meaning & Other Related Ratios

In order to calculate the debt-to-equity ratio, you need to understand both components. Lenders and investors perceive borrowers funded primarily with equity (e.g. owners’ equity, outside equity raised, retained earnings) more favorably. So, the debt-to-equity ratio of 2.0x indicates that our hypothetical company is financed with $2.00 of debt for each $1.00 of equity. This means that for every $1 invested into the company by investors, lenders provide $0.5. However, because the company only spent $50,000 of their own money, the return on investment will be 60% ($30,000 / $50,000 x 100%).

To Ensure One Vote Per Person, Please Include the Following Info

The D/E ratio illustrates the proportion between debt and equity in a given company. In other words, the debt-to-equity ratio shows how much debt, relative to stockholders’ equity, is used to finance the company’s assets. Gearing ratios are financial ratios that indicate how a company is using its leverage.

- If you want to express it as a percentage, you must multiply the result by 100%.

- Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

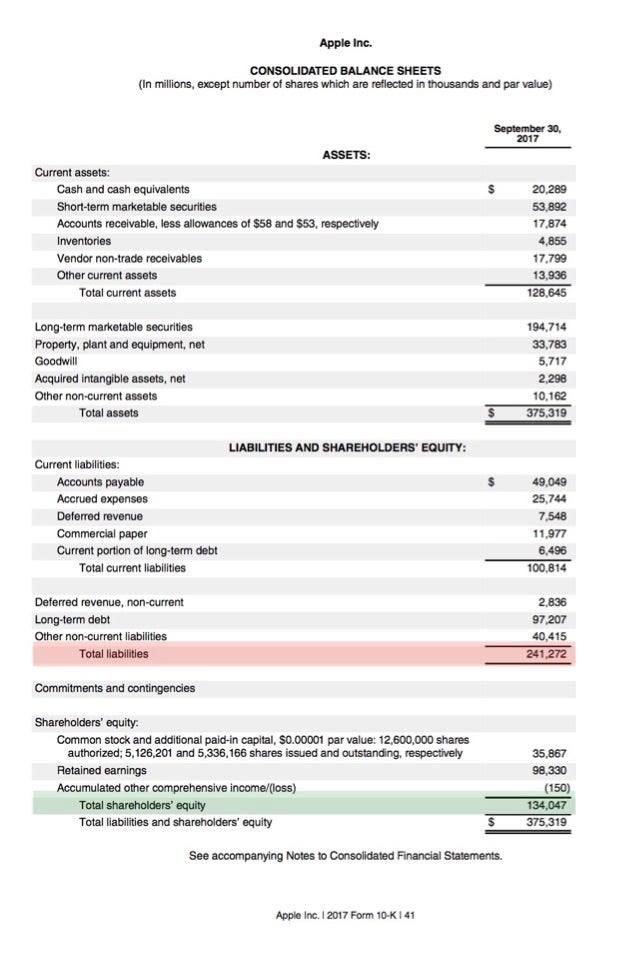

- The debt-to-equity ratio (D/E) compares the total debt balance on a company’s balance sheet to the value of its total shareholders’ equity.

- You can calculate the D/E ratio of any publicly traded company by using just two numbers, which are located on the business’s 10-K filing.

- High leverage ratios in slow-growth industries with stable income represent an efficient use of capital.

Loan Calculators

Because equity is equal to assets minus liabilities, the company’s equity would be $800,000. Its D/E ratio would therefore be $1.2 million divided by $800,000, or 1.5. The personal D/E ratio is often used when an individual or a small business is applying for a loan. Lenders use the D/E figure to assess a loan applicant’s ability to continue making loan payments in the event of a temporary loss of income. Finally, if we assume that the company will not default over the next year, then debt due sooner shouldn’t be a concern. In contrast, a company’s ability to service long-term debt will depend on its long-term business prospects, which are less certain.

Retention of Company Ownership

In this guide, we’ll explain everything you need to know about the D/E ratio to help you make better financial decisions. If you want to express it as a percentage, you must multiply the result by 100%. These industry-specific factors definitely matter when it comes to assessing D/E.

Statistics and Analysis Calculators

A challenge in using the D/E ratio is the inconsistency in how analysts define debt. Therefore, comparing D/E ratios across different industries should be done with caution, as what is normal in one sector may not be in another. Let’s examine a hypothetical company’s balance sheet to illustrate this calculation. As implied by its name, total debt is the combination of both short-term and long-term debt. As you can see, company A has a high D/E ratio, which implies an aggressive and risky funding style. Company B is more financially stable but cannot reach the same levels of ROE (return on equity) as company A in the case of success.

Example D/E ratio calculation

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The cash ratio is a useful indicator of the value of the firm under a worst-case scenario. Aside from that, they need to allocate capital expenditures for upgrades, maintenance, and expansion of service areas.

This could mean that investors don’t want to fund the business operations because the company isn’t performing well. Lack of performance might also be the reason why the company is seeking out extra debt financing. Each industry has different debt to equity ratio benchmarks, as some industries tend to use more debt financing than others.

The nature of the baking business is to take customer deposits, which are liabilities, on the company’s balance sheet. Some analysts like to use a modified D/E ratio to calculate the figure using only long-term debt. And, when analyzing a company’s debt, you would also want to consider how mature the debt is as well how to leverage equity capital with debt as cash flow relative to interest payment expenses. As an example, many nonfinancial corporate businesses have seen their D/E ratios rise in recent years because they’ve increased their debt considerably over the past decade. Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2).

This calculation gives you the proportion of how much debt the company is using to finance its business operations compared to how much equity is being used. For example, let us say a company needs $1,000 to finance its operations. If the company were to use equity financing, it would need to sell 100 shares of stock at $10 each. It is the opposite of equity financing, which is another way to raise money and involves issuing stock in a public offering. Investors can use the debt-to-equity ratio to help determine potential risk before they buy a stock.

The concept of a “good” D/E ratio is subjective and can vary significantly from one industry to another. Industries that are capital-intensive, such as utilities and manufacturing, often have higher average ratios due to the nature of their operations and the substantial amount of capital required. Therefore, it is essential to align the ratio with the industry averages and the company’s financial strategy. Companies can improve their D/E ratio by using cash from their operations to pay their debts or sell non-essential assets to raise cash. They can also issue equity to raise capital and reduce their debt obligations.

Company B has $100,000 in debentures, long term liabilities worth $500,000 and $50,000 in short term liabilities. At the same time, the company has $250,000 in shareholder equity, $60,000 in reserves and surplus, and $10,000 in fictitious assets. This result means that for every dollar of equity, Company D has three dollars in debt. A high D/E ratio can be a red flag for investors and creditors as it suggests a high degree of leverage and risk. However, it could also mean that the company is aggressively financing its growth with debt.

Leave a Reply