Intuit QuickBooks Payroll Review

Content

Don’t sweat quarter and year-end Quickbooks Payroll s, we take care of all the tax stuff for you. Intuit’s payroll experts will help you get set up and answer any questions you might have. With Intuit’s Tax Penalty Protection , they’ll resolve filing errors—and pay any penalty fees. Select Save after entering your routing and account number. If you have a payroll module, it is essential to update it at least every three years. If you have any further questions or need additional information to make a decision, reach out to us to discuss further.

- HomePay Payroll Review 2023 We dive into HomePay’s pricing, customer reviews, & user-friendliness.

- Even their staff couldn’t figure out how to change this simple number.

- ADP offers several affordable options depending on a company’s size as well as on its payroll and HR requirements, so you only pay for what you require.

- They can also apply for leave, view leave balances and enter time sheets on the portal.

- You can also use our pay-as-you-go workers’ compensation service to automatically pay exactly what you owe each pay day.

QuickBooks falls into the latter camp; its HR support center is only accessible to those on the Premium and Elite plans. If you sign up for those plans, you can take advantage of templates for onboarding checklists, employee handbooks and job descriptions. The Elite package also grants companies access to HR advisors who can provide guidance on various aspects of people management.

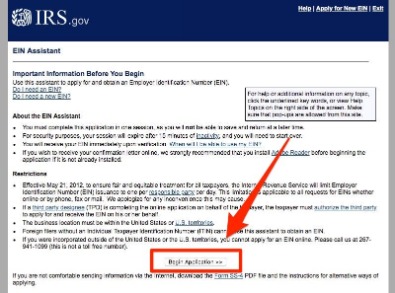

E-File & Pay

If QuickBooks Payroll isn’t a good fit for you, check out our page comparing payroll software to find a payroll plan that is. But if you pay employees in multiple states, a QuickBooks competitor like Gustowith free multi-state payroll will cost less in the long run. And QuickBooks Payroll lacks some key HR features, so if you want more employee benefits and in-house insurance brokers, you’ll get more bang for your buck with Gusto or Paychex. Like most payroll software, QuickBooks Payroll includes a tax-filing accuracy guarantee with each plan. This guarantee means that QuickBooks Payroll will pay any IRS fines incurred by a QuickBooks-caused problem. For more reviews of money management apps, take a look at our lists of the best personal finance apps, the best ta software, and the best accounting software for small businesses. You can invite employees to access their W-2 and paycheck information from a separate, password-protected site.

They must not only end the year concerning their payroll tasks, but also prepare for the filing of payroll-related taxes, sending W-2s, and the many other things that must get done. Some business owners prefer to use desktop-based software than a cloud-based program to manage their payroll. A well-equipped payroll system can save you and your employees hours of time each month, automate compliance obli…

QuickBooks Desktop Payroll Explained

Further, many were posted by Intuit representatives, but others came from unverified people in the user community, which aren’t necessarily accurate. While the benefits may not be so obvious if you’re a small business owner not using QuickBooks Online Accounting, you can still benefit from using Intuit QuickBooks Online Payroll. You will have affordable access to full-service payroll at any plan level, free direct deposit, and a portal that lets employees track vacation and sick time in the application. The Elite plan is currently discounted 50% to $62.50 per month for the first three months, which then jumps to $125 per month, plus a $10 per employee additional fee. The Elite plan offers onboarding, access to a personal HR advisor, plus all of the features found in the Core and Premium plans. The Elite plan also lets you pay employees in an unlimited number of states at no extra charge. The application will automatically calculate, process, and file payroll tax forms, including tax deposits, for all 50 states, where necessary.

Intuit’s (INTU) Q2 Earnings and Revenues Beat Estimates – Nasdaq

Intuit’s (INTU) Q2 Earnings and Revenues Beat Estimates.

Posted: Fri, 24 Feb 2023 15:26:00 GMT [source]

In addition we called to cancel our payroll service and the representative told us a account was canceled for payroll. However they continue to charge us month after month $500 and refused to refund any amount citing their contract stipulated no refunds.

Why ADP is more robust compared to QuickBooks Payroll

Elite onboarding is currently a feature in QuickBooks Online Payroll Elite. Stayed tuned to learn more as we work to expand our onboarding services.

- Rippling’s benefits and human resources administration capabilities are unrivaled in the group of websites I reviewed here.

- But if you pay employees in multiple states, a QuickBooks competitor like Gustowith free multi-state payroll will cost less in the long run.

- There’s even an option for the system to invite employees to track and record their work hours via QuickBooks Time.

- See how we help organizations like yours with a wider range of payroll and HR options than any other provider.

- When we first started the business, we were using QuickBooks to do payroll.

- If you are currently opted out, consider opting in to have QuickBooks file taxes and returns for you in the new year.

The next two tabs open screens that are far less complicated. You https://intuit-payroll.org/ contact information under the Profile tab and details such as hire date and work location under Employment. All the data you just entered appears under the Employee Details tab on the Employee screen. “How much do you pay Dave?” is the introduction to the next task, where you indicate whether Dave is paid an hourly rate, salary, or on commission only.

Leave a Reply