Types of dividends

Some financial analysts believe that the consideration of a dividend policy is irrelevant because investors have the ability to create “homemade” dividends. These analysts claim that income is achieved by investors adjusting their asset allocation in their portfolios. Diversification should always be top of mind for any investor, and someone who focuses too much on dividends is likely to ignore some sectors and classes of companies they need for good diversification. Young, fast-growing tech companies, for example, don’t generally pay dividends.

Expense accounts:

If you’ve been a business owner for any length of time, you’ve probably seen a wide variety of different accounts or sub-accounts, which can vary wildly. What’s more, they are often customized to fit the business owner’s specific needs. Cash is a Real account so Dr. what comes in (9,500), Discount Allowed A/c is a Nominal account so Dr. all expenses/losses (500), and Unreal Co.

Dividend Income – Sourcing

Most companies that pay a regular dividend do so quarterly, although some pay monthly, biannually, or annually. After the board of directors agrees on the amount of a dividend payment, the company officially declares — announces — its next dividend. These dividends pay out on all shares of a company’s common stock, but don’t recur like regular dividends.

The Payout Ratio: Why It Matters

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission adjusting entries when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

- Accounting for dividends starts with determining if the company has sufficient cash on hand to distribute a dividend.

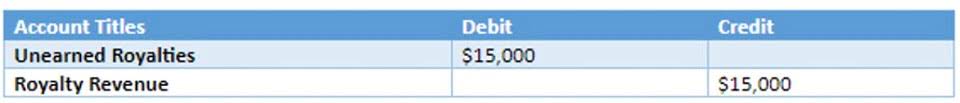

- Such unearned revenue would be recorded as a liability as long as the related marketing services against it are not provided to the client who has made the advance payment.

- • The dividends are not the type listed by the IRS under dividends that are not qualified dividends.

- Evaluating dividend stocks requires some research, like evaluating other types of stocks.

- Unlike cash dividends, stock dividends are not taxed until the investor sells the shares.

- A high dividend payout ratio is good for short term investors as it implies a high proportion of the profit of the business is paid out to equity holders.

- Known as “dividend reinvestments,” they increase the number of shares outstanding by giving new shares to shareholders instead of cash.

Why do companies pay dividends?

But the company’s business came under pressure, and its shares fell to $50—although it’s still paying $5 in https://www.bookstime.com/ annual dividends. In a relatively short period of time, the dividend yield would’ve doubled to 10% from 5%. In this case, the rising dividend yield is a sign of stress, not a sign of a healthy company. After the dividends are paid, the dividend payable is reversed and is no longer present on the liability side of the balance sheet. When the dividends are paid, the effect on the balance sheet is a decrease in the company’s retained earnings and its cash balance. In other words, retained earnings and cash are reduced by the total value of the dividend.

What are the most common types of dividend?

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments. This is the type of dividend paid to shareholders during a partial or full liquidation.

Companies may choose to pay dividends in the form of extra shares instead of cash. This can be a perk for shareholders because these stock dividends are not taxed until the shareholder sells these shares. “Essentially each shareholder owns the same percentage of the company after receiving the stock dividend as they did before receiving the stock dividend,” says Johnson. Yes, dividends earned in dividend checking accounts are typically considered what type of account is dividends taxable income. The interest paid by the bank or credit union is reported to the IRS, and you must include it in your annual tax return. The financial institution will usually send you a Form 1099-INT or 1099-DIV at the end of the year, detailing the total interest you earned on the account for the year.

Leave a Reply