Double Declining Balance Method of Deprecitiation Formula, Examples

By dividing the $4 million depreciation expense by the purchase cost, the implied depreciation rate is 18.0% per year. The prior statement tends to be true for most fixed assets due to normal “wear and tear” from any consistent, constant usage. The amount of final year depreciation will equal the difference between the book value of the laptop at the start of the accounting period ($218.75) 8615 instructions and the asset’s salvage value ($200). Sara wants to know the amounts of depreciation expense and asset value she needs to show in her financial statements prepared on 31 December each year if the double-declining method is used. In the first year of service, you’ll write $12,000 off the value of your ice cream truck. It will appear as a depreciation expense on your yearly income statement.

Debit vs. Credit Differences in Accounting: Rules and Examples

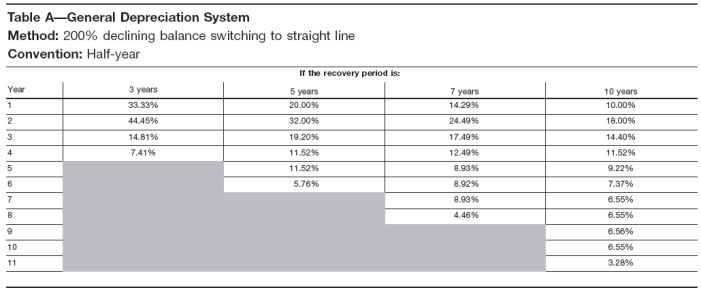

Under the straight-line depreciation method, the company would deduct $2,700 per year for 10 years–that is, $30,000 minus $3,000, divided by 10. We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month. Simultaneously, you should accumulate the total depreciation on the balance sheet. It is advisable to consult with a professional accountant to ensure that depreciation is accurately recorded in compliance with accounting standards and regulations. Under the declining balance method, depreciation is charged on the book value of the asset and the amount of depreciation decreases every year. What it paid to acquire the asset — to some ultimate salvage value over a set period of years (considered the useful life of the asset).

Calculating Depreciation Expense Using DDB

It involves more complex calculations but is more accurate than the Double Declining Balance Method in representing an asset’s wear and tear pattern. This method balances between the Double Declining Balance and Straight-Line methods and may be preferred for certain assets. When you run a business, you have to be aware of the useful life of your assets. Some assets have lives that last for decades, while others can only be counted on for a few years.

- However, it may also apply to business assets like computers, mobile devices and other electronics.

- If you’ve taken out a loan or a line of credit, that could mean paying off a larger chunk of the debt earlier—reducing the amount you pay interest on for each period.

- This method takes most of the depreciation charges upfront, in the early years, lowering profits on the income statement sooner rather than later.

- Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

What is the double declining balance method of depreciation?

But I do recommend working with your CPA or financial advisor to set-up depreciation schedules for any new assets your business may acquire. Our AI-powered Anomaly Management Software helps accounting professionals identify and rectify potential ‘Errors and Omissions’ on a daily basis so that precious resources are not wasted during month close. It automates the feedback loop for improved anomaly detection and reduction of false positives over time.

You might be confused about why the purchase of an expensive asset isn’t considered an outright expense. This is because of the generally accepted accounting principles, or GAAP. GAAP states that when an asset is to be used for many years, the purchase needs to be deducted over time.

The percentage of the straight-line depreciation can be anywhere from 150 to 250 percent of what it normally is. The original cost of the item is still relevant, but over time they don’t maintain that original value. When you’re doing your business’s accounting, depreciation is a concept that you need to be familiar with. DDB depreciation is less advantageous when a business owner wants to spread out the tax benefits of depreciation over a product’s useful life. This is preferable for businesses that may not be profitable yet and, therefore, may be unable to capitalize on greater depreciation write-offs or businesses that turn equipment assets over quickly. In contrast to straight-line depreciation, DDB depreciation is highest in the first year and then decreases over subsequent years.

This method takes most of the depreciation charges upfront, in the early years, lowering profits on the income statement sooner rather than later. Our solution has the ability to record transactions, which will be automatically posted into the ERP, automating 70% of your account reconciliation process. Therefore, the book value of $51,200 multiplied by 20% will result in $10,240 of depreciation expense for Year 4. At Taxfyle, we connect individuals and small businesses with licensed, experienced CPAs or EAs in the US. We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will handle filing taxes for you.

For reporting purposes, accelerated depreciation results in the recognition of a greater depreciation expense in the initial years, which directly causes early-period profit margins to decline. Understanding the tools available for double declining balance depreciation can greatly enhance your financial management skills. By utilizing calculators, templates, and educational resources, you can make informed decisions that benefit your business. If, for example, an asset is purchased on 1 December and the financial statements are prepared on 31 December, the depreciation expense should only be charged for one month. 1- You can’t use double declining depreciation the full length of an asset’s useful life.

Leave a Reply